When Should You Aim to Retire From Teaching?

10 Sep - Posted at 14:32h in Retirement Planning

The average retirement age in the U.S. is 62, but teachers typically retire a few years earlier. Nowadays, you can expect to live 20 years past your retirement age. This leaves you asking the question, “How do I know when to retire from teaching and how much money will I need?”

First things first, you'll want to make sure you're in good financial standing and that you're receiving the maximum amount of benefits to ensure your basic needs will be taken care of.

How Do I Know When to Retire from Teaching?

When you should retire as a teacher depends on a few factors, and the complexities of these vary from state to state and from person to person.

There are a few points every teacher can keep in mind, however.

You'll want to make sure you're retiring and maximizing your state pension as best you can.

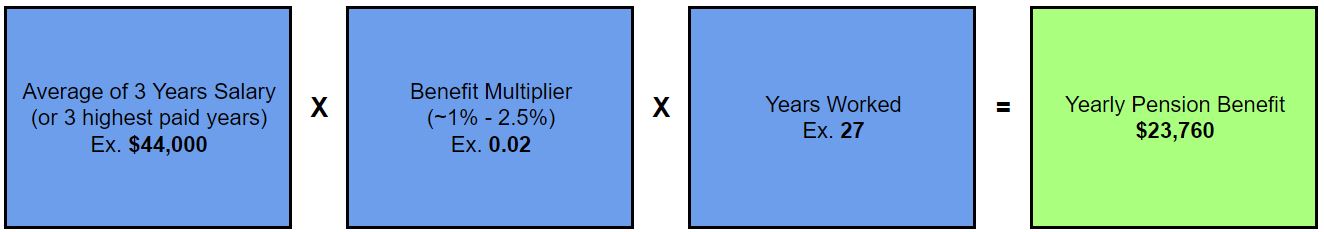

Calculate your pension benefits. This is usually based on how many years you worked, your average salary over the last few years before retirement, age factor, and a few other nuances that vary by pension system. Keep in mind your retirement benefits may be reduced if you decide to retire early. You can use this government site to help estimate your retirement earnings. Here's an example of a pension benefit calculation.

Check your state's minimum retirement age.

For many states, to retire early means drastically sacrificing your retirement benefits in the process. Make sure to know your options and numbers NOW, not when you are filling out your retirement paperwork.

Look over your budget

Savings accounts, debts, potential social security benefits, a 403(b), and your current assets will all come into play. You need to understand your budget to know when to retire from teaching.

Talk to a professional to figure out how these all work together in conjunction with your pension and overall retirement plan.

Figure out your health insurance situation

Do your retirement benefits include a health care plan? In Michigan, a health insurance plan is offered for the retiree and eligible dependents; this is deducted from your pension benefits every month. Some states, like New Jersey and Texas, require a minimum number of years worked before they offer this benefit.

Will you be able to receive Medicare? If not, you may have to look into private insurance. Private insurance can be tricky, and if you have underlying health conditions it can increase the cost of your premium.

Can you receive coverage through your spouse? For many this is a good option if they have a spouse that is still in the workforce. However, when your spouse retires this may leave you with a gap in coverage. You'll want a plan for when that happens.

Decide what you want your retirement to look like

In some states, it is possible to retire, collect your pension, and still work part time for the same school district, or continue work in the private sector.

This is what Debby from Michigan decided to do. She was able to work for the same school, earning up to half of her pension amount during her first year of retirement. This will continue into her second year of retirement, unless the position is deemed “difficult-to-fill.” If that's the case, Debby could work earning up to her full pension amount.

When it came to deciding what she wanted her retirement to look like, she chose to explore other employment options in the private sector, like driving a bus for wine tours and working in an embroidery shop. These decisions came about, not because she needed more funds, but because keeping busy keeps her happy. She also appreciates having extra money. It allows her to enjoy spending in retirement, and working in the private sector doesn't affect her pension at all. She notes that in retirement it was important for her to choose positions that allowed her the freedom to set her own hours and not be obligated to anyone else.

The point here is to plan ahead and design your retirement vs. letting it run you!

Talk with a Financial Professional to Plan Your Retirement

Having someone on your side who understands the complexities of retirement is crucial. At Appreciation Financial you have the benefit of an award-winning financial service on your side. You can work with an industry professional who excels as serving teachers and public employees. This means you won't be alone through the tough decisions. We'll be on your side!

Image by Mohamed Hassan on Shutterstock